Details, Fiction and Fairfax Bankruptcy Attorney

Chapter 13. It's less of a challenge to qualify for Chapter thirteen than for Chapter 7. Instead of erasing your credit card debt, this sort of filing reorganizes your investing. You'll get to keep the assets, nevertheless the courtroom will buy a finances so that you can live on, which will incorporate a every month payment plan for your debts.

Somewhere around the amount of unsecured personal debt for instance healthcare, credit card and private financial loans do you've? Make sure you never consist of auto or pupil financial loans.

Arrive at Money concentrates on financial loans for the purpose of staying away from bankruptcy. The company has an awesome status, each with the BBB and its consumers.

Then, you’ll authorize us to make use of the resources within your Dedicated Cost savings Account to pay for your creditors the lower, negotiated quantities. Can I Afford to pay for This? Totally! 1000s of men and women each month figure out that our system works for them. Nationwide Financial debt Aid goes much further than ensuring you'll be able to afford our method – we make the effort to assessment your finances to produce a personalized software that will relieve both equally your financial burden along with your stress.

Chapter nine. This is another repayment plan which allows towns, towns, and various governing administration entities the opportunity to reorganize and spend back again their debts.

The vast majority of leftover personal debt will be forgiven. That has a Chapter thirteen bankruptcy, the court will purchase you to Stay within a finances for as much as 5 several years, in which period most of your respective debt might be repayed. In any case, creditors will stop contacting and you can begin getting your fiscal life again if you want.

It should really. One among the largest black marks on go right here your own credit history score is obtaining late or skipped payments, and consolidating all of your financial debt into just one month to month payment makes it far more possible you'll spend in time.

While it's superior to own the choice to declare bankruptcy, it's not difficult to see why it should commonly be the final possibility. Declaring bankruptcy is actually a drastic action to choose, and can effect your lifetime for years to come.

LendingTree is an on-line personal loan marketplace For each sort of borrowing, from vehicle loans to charge cards and beyond. If you're seeking a mortgage to repay your present higher fascination click over here now personal debt, You should use this company to simply Evaluate delivers from up to 5 lenders at a time, serving to you obtain the best charges and terms for your own mortgage.

Remain updated with the most recent evaluations. We'll preserve you informed, and we are going to under no circumstances offer your data to any individual.

Usually, no. If you take out a personal debt consolidation financial loan, his explanation it's on you to know all of the stipulations before you decide to sign off. Even so, There are some charge-primarily based visit the website expert services that do provide a 100% gratification ensure that allows you to terminate without the need of penalty.

Price tag. Does the corporation charge a price to critique your finances and craft an answer? What sort of programs do they offer? If it's a loan, are their prices aggressive?

Do you have got any choice with regards to the period of time you invest with an attorney? Additional time Along with the attorney is more customized, but could be a higher Charge.

If you're taking into consideration filing for bankruptcy, you're not by yourself. On read the article a yearly basis, a huge selection of thousands of people file for bankruptcy thanks to their too much to handle credit card debt.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Alexa Vega Then & Now!

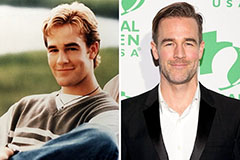

Alexa Vega Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!